We spent many hours on research to finding financial help, reading product features, product specifications for this guide. For those of you who wish to the best financial help, you should not miss this article. financial help coming in a variety of types but also different price range. The following is the top 6 financial help by our suggestions:

Best financial help

1. Broke Millennial: Stop Scraping By and Get Your Financial Life Together

Description

WASHINGTON POST COLOR OF MONEY BOOK CLUB PICKStop Living Paycheck to Paycheck and Get Your Financial Life Together (#GYFLT)!

If youre a cash-strapped 20- or 30-something, its easy to get freaked out by finances. But youre not doomed to spend your life drowning in debt or mystified by money. Its time to stop scraping by and take control of your money and your life with this savvy and smart guide.

Broke Millennial shows step-by-step how to go from flat-broke to financial badass. Unlike most personal finance books out there, it doesnt just cover boring stuff like credit card debt, investing, and dealing with the dreaded B word (budgeting). Financial expert Erin Lowry goes beyond the basics to tackle tricky money matters and situations most of us face #IRL, including:

- Understanding your relationship with moolah: do you treat it like a Tinder date or marriage material?

- Managing student loans without having a full-on panic attack

- What to do when youre out with your crew and cant afford to split the bill evenly

- How to get financially naked with your partner and find out his or her number (debt number, of course) ... and much more.

Packed with refreshingly simple advice and hilarious true stories, Broke Millennial is the essential roadmap every financially clueless millennial needs to become a money master. So what are you waiting for? Lets #GYFLT!

2. The Financial Diet: A Total Beginner's Guide to Getting Good with Money

Description

*A Refinery29 Best Book of 2018*

*One of Real Simple's Most Inspiring Books for Graduates*

How to get good with money, even if you have no idea where to start.

The Financial Diet is the personal finance book for people who dont care about personal finance. Whether youre in need of an overspending detox, buried under student debt, or just trying to figure out how to live on an entry-level salary, The Financial Diet gives you tools to make a budget, understand investments, and deal with your credit. Chelsea Fagan has tapped a range of experts to help you make the best choices for you, but she also knows that being smarter with money isnt just about what you put in the bank. Its about everythingfrom the clothes you put in your closet, to your financial relationship habits, to the food you put in your kitchen (instead of ordering in again). So The Financial Diet gives you the tools to negotiate a raise and the perfect cocktail recipe to celebrate your new salary.

The Financial Diet will teach you:

how to get good with money in a year.

the ingredients everyone needs to have a budget-friendly kitchen.

how to talk about awkward money stuff with your friends.

the best way to make (and stick to!) a budget.

how to take care of your house like a grown-up.

what the hell it means to invest (and how you can do it).

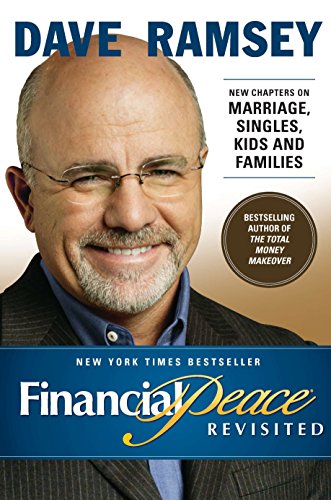

3. Financial Peace Revisited: New Chapters on Marriage, Singles, Kids and Families

Feature

MoneyDescription

Dave Ramsey knows what it's like to have it all. By age twenty-six, he had established a four-million-dollar real estate portfolio, only to lose it by age thirty. He has since rebuilt his financial life and, through his workshops and his New York Times business bestsellers Financial Peace and More than Enough, he has helped hundreds of thousands of people to understand the forces behind their financial distress and how to set things right-financially, emotionally, and spiritually.In this new edition of Financial Peace, Ramsey has updated his tactics and philosophy to show even more readers:

- how to get out of debt and stay out

- the KISS rule of investing"Keep It Simple, Stupid"

- how to use the principle of contentment to guide financial decision making

- how the flow of money can revolutionize relationships

With practical and easy to follow methods and personal anecdotes, Financial Peace is the road map to personal control, financial security, a new, vital family dynamic, and lifetime peace.

4. Rich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together.Finally

Feature

William Morrow CoDescription

In this New York Times bestseller, journalist and financial expert Nicole Lapin shows women how to take charge of their lives by taking charge of their money.

Do your eyes glaze over just thinking about the mumbo-jumbo language of finance? Do you break out into hives when faced with getting your financial life together? Well, sister, you are not alone.

In Rich Bitch, money expert and financial journalist Nicole Lapin lays out a 12-Step Plan in which she shares her experiencesmistakes and allof getting her own finances in order. She talks to you not like a lecturer but as your friend. And even though money is typically an off-limits conversation, nothing is off-limits here.

Lapin rethinks every piece of financial wisdom youve ever heard and puts her own fresh, modern, sassy spin on it. Sure, there are some hard-and-fast rules about finance, but when it comes to your money, the only person who can tell you how to spend it is you. Should you invest in a 401(k)? Maybe not. Should you splurge on that morning latte? Likely yes. Instead of focusing on nickel-and-diming yourself, Nicoles advice focuses on investing in yourself so you dont have to stress over the little things.

Rich Bitch rehabs whatever bad money habits you might have and provides a plan you can not only sustain, but also thrive on. You wont feel deprived but rather inspired to go after the rich life you deserve, and confident enough to call yourself a rich bitch.

5. Broke Millennial Takes On Investing: A Beginner's Guide to Leveling Up Your Money

Description

A guide to investing basics by the author of Broke Millennial, for anyone who feels like they aren't ready (or rich enough) to get into the marketMillennials want to learn how to start investing. The problem is that most have no idea where to begin. There's a significant lack of information out there catering to the concerns of new millennial investors, such as:

*Should I invest while paying down student loans?

*How do I invest in a socially responsible way?

*What about robo-advisors and apps--are any of them any good?

*Where can I look online for investment advice?

In this second book in the Broke Millennial series, Erin Lowry answers those questions anddelivers all of the investment basics in one easy-to-digest package. Tackling topics ranging from common terminology to how to handle your anxiety toretirement savings and even how to actually buy and sell a stock, this hands-on guide will help any investment newbie become a confident player in the market on their way to building wealth.

6. The SBA Loan Book: Get A Small Business Loan-even With Poor Credit, Weak Collateral, And No Experience (SBA Loan Book: The Complete Guide to Getting Financial Help)